UNLOCK YOUR FIRST HOME WITH EASE

TURN YOUR DREAM OF OWNING A HOME INTO REALITY - WITHOUT THE STRESS OR CONFUSION

AFFORDABLE HOME LOANS TAILORED TO YOU - NO HIDDEN FEES, NO SURPRISES

CLICK BELOW TO WATCH FIRST!

Next Step: Complete the survey below to book in your discovery call - only a few spots left!

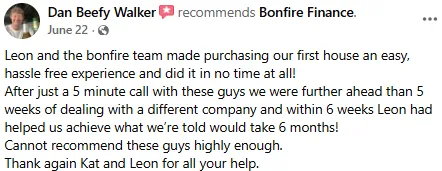

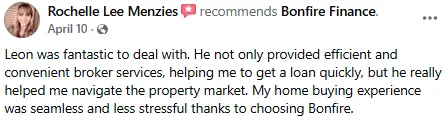

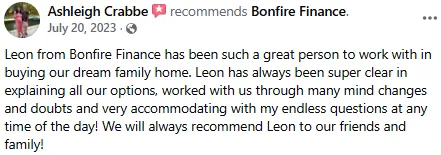

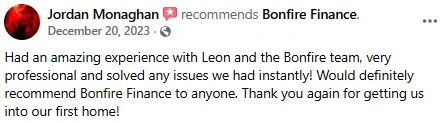

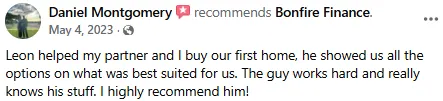

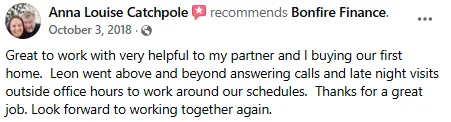

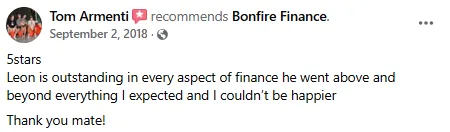

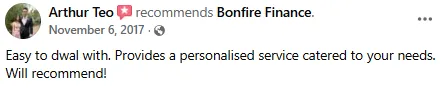

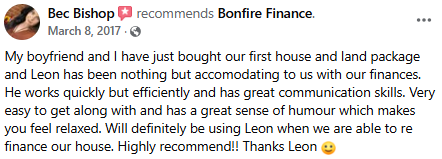

Read Stories from People Just Like You

For First Home Buyers Ready to Ditch Renting and Own Their First Home

RENTERS SAVING FOR THEIR FIRST HOME DEPOSIT

YOUNG PROFESSIONALS NAVIGATING THE MORTGAGE PROCESS FOR THE FIRST TIME

COUPLES PLANNING TO BUY THEIR FIRST HOME TOGETHER

INDIVIDUALS SEEKING CLaRITY ON GOVERNMENT GRANTS AND INCENTIVES FOR FIRST HOME BUYERS

PEOPLE OVERWHELMED BY THE COMPLEXITIES OF PROPERTY HUNTING AND FINANCING

ASPIRING HOMEOWNERS MOTIVATED BY THE DESIRE FOR STABILITY AND INDEPENDENCE

STILL NOT SURE?

Frequently Asked Questions

Here's what we usually get asked

1. How much deposit do I need to buy my first home?

Typically, you'll need at least 5-20% of the property price, but there are government schemes and lender options that can reduce this. We'll guide you through the best options for your situation.

2. What government grants or incentives am I eligible for?

First home buyers may qualify for grants, stamp duty concessions, and/or Home Guarantee Schemes like the First Home Guarantee or Family Home Guarantee. We'll guide you through understanding these options and help you access the ones you're eligible for.

3. How do I know how much I can borrow?

Your borrowing capacity is primarily determines by your income, living expenses, and existing credit commitments. We'll help you assess these factors and work with our panel of over 40 lenders to find the best options tailored for your unique situation.

4. What's the process of buying my first home?

From saving for a deposit to securing a loan, finding a property, and settling the purchase, we break it down step-by-step so you're never overwhelmed.

5. What hidden costs should I budget for?

Beyond the deposit, there are costs like stamp duty, legal and settlement fees, inspections, lenders fee's and insurance. We'll help you plan for these so there are no surprises.

6. What options are available if I'm worried about my financial situation?

There are plenty of options to help you get started, even if you're feeling unsure about your finances. From government schemes like the first home guarantee to budgeting strategies and tailored loan options from our panel of over 40 lenders, we'll help you navigate the process and find a solution that works for you.

How It Works in 3 Simple Steps

Step 1 – Take the Survey + book a call

We’ll start with a quick chat about your current loan and goals. No stress, no sales pitch — just an honest look at where you’re at.

Step 2 – We Do the Hard Work

We’ll compare options across lenders, crunch the numbers, and find the deal that works harder for you (not your bank). Get us the documents we need so you can sit back while we handle the paperwork and the back-and-forth.

Step 3 – Start Your Journey

Once you’re happy, we’ll get your new loan sorted and guide you through the whole process to settlement. We'll be with you every step of the way.

Ready to get started?

MEET THE Founder and Director

Hi, I'm Leon

Founder and Director Mortgage Broker at Bonfire Finance. Based in Subiaco, our boutique mortgage brokerage proudly services the whole Perth and Peel regions as well as the wider WA – and I’ve made it my mission to help first home buyers like you take the big step into home ownership with confidence.

With over a decade in mortgage broking (and another eight years in banking before that), I’ve worked with hundreds of first home buyers – from singles to couples and young families – guiding them through every stage of the journey. I know that buying your first home isn’t just about numbers on a page; it’s about creating security, freedom, and a place that’s truly your own.

At Bonfire Finance, we specialise in first home buyers. That means we don’t just find you a loan – we help you understand your options, access government grants and schemes, and make sure your first step onto the property ladder is a strong one. My team and I pride ourselves on being approachable, transparent, and 100% focused on what’s best for you.

Think of us as your mortgage co-pilot: we’ll handle the tricky lender stuff so you can focus on the exciting part – getting the keys to your first home.