HOMEOWNERS: Unlock Better Rates & Save Thousands on your mortgage

STOP OVERPAYING: PERTH HOMEOWNERS, IT'S TIME TO TAKE BACK CONTROL OF YOUR MORTGAGE.

Start Your Refinancing Journey Today and Save Thousands Over the Life of Your Loan.

CLICK BELOW TO WATCH FIRST!

Next Step: Answer a few quick questions to start your free home or investment loan review - limited spots available so act now to secure yours!

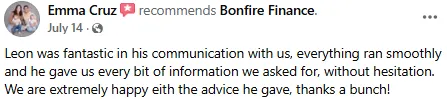

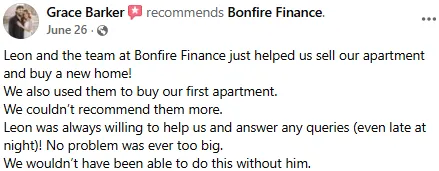

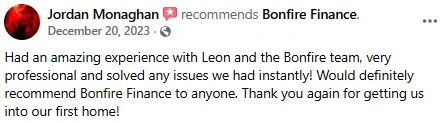

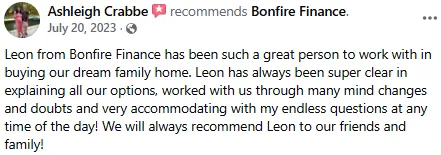

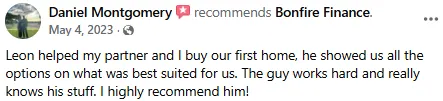

We could talk about saving people money all day… but it’s way better coming from the client's we’ve helped.

This is for homeowners who are ready to stop overpaying and start getting more from their mortgage.

For example...

Aussie Homeowners tired of handing hard earned cash to the bank

People wanting extra breathing room in the budget (for life, not just bills)

Families, singles, and couples dreaming of renos, Investing, or a place with more space

First-time refinancers who just want the process explained simply

Busy people who don’t have time for bank jargon or endless forms

Anyone ready to save moneY AND feel good about their loan again

STILL NOT SURE?

Frequently Asked Questions

Here's what we usually get asked

1. How much will it cost me to refinance through Bonfire Finance?

For most standard home loan services, including refinancing and equity release, our service comes at no cost to you. In Australia, mortgage brokers are usually paid by the lender once your new loan settles. This means you get our expert advice, access to a wide range of lenders, and help with all the paperwork — all without paying any direct fees. We pride ourselves on transparency and will always explain exactly how we’re remunerated, so you can feel confident every step of the way.

2. How long does the refinancing process take?

Refinancing timelines can vary depending on your lender and circumstances, but most clients complete the process within 4–6 weeks. Our team handles the paperwork, communication, and follow-ups, making it as smooth and stress-free as possible.

3. Can I refinance if I have existing debts or a complicated financial situation?

Absolutely. One of the main reasons homeowners refinance is to consolidate debts or restructure their finances. We’ll review your situation in detail and work out a solution that helps you save money, reduce stress, and achieve your financial goals.

4. Why should I use a mortgage broker instead of going directly to a bank?

We have access to a wide range of lenders (over 40) and exclusive deals you may not find on your own. A boutique brokerage like Bonfire Finance takes the time to understand your goals, compares all suitable options, and manages the entire process — saving you time, effort, and money.

5. I’m too busy — is refinancing going to take a lot of my time?

Not at all! That’s where we come in. Bonfire Finance handles the research, paperwork, and lender communications for you. Most clients only need to provide key documents and approve the recommendations, making the process quick and stress-free.

6. I’m not sure it’s worth the effort — will I really save money?

Many of our clients save thousands over the life of their loan. Even a small drop in your interest rate or better loan features can make a significant difference in your monthly repayments and long-term costs. We’ll provide a clear savings estimate so you know exactly what’s achievable before you make any decisions.

7. I’m worried about hidden fees or costs.

Transparency is important to us. We’ll explain any potential fees upfront, and most standard refinancing services, including equity release, are completely free for you. Our goal is to save you money, not create unexpected costs.

8. What if my financial situation is complicated?

No problem! Whether you have existing debts, multiple income sources, or unique circumstances, we can find solutions tailored to you. We’ll guide you through every step, making sure your refinance works in your best interest.

9. I’m happy with my current bank — why should I consider switching?

Even if you like your current lender, there may be better options available that save you money or provide more flexible features. Remember they only tell you the best they can offer, not what other Lenders are offering! A quick review with a broker doesn’t commit you to switching, but it ensures you’re not missing out on potential savings or benefits.

How It Works in 3 Simple Steps

Step 1 – Book Your Free Refinance Review

We’ll start with a quick chat about your current loan and goals. No stress, no sales pitch — just an honest look at where you’re at.

Step 2 – We Do the Hard Work

We’ll compare options across lenders, crunch the numbers, and find the deal that works harder for you (not your bank). Get us the documents we needYou can sit back while we handle the paperwork and the back-and-forth.

Step 3 – Lock In Your Savings

Once you’re happy, we’ll get your new loan sorted and guide you through to settlement. You’ll walk away with lower repayments, more freedom, and the confidence your loan is finally working for you.

Ready to get started?

MEET THE Founder and Director

Hi, I'm Leon

Founder and Director Mortgage Broker at Bonfire Finance. Based in Subiaco, our boutique mortgage brokerage proudly services the whole Perth and Peel regions as well as the wider WA – and I’ve made it my mission to help homeowners like you take control of your finances and unlock the potential of your property.

With over a decade in mortgage broking (and another eight years in banking before that), I’ve worked with hundreds of clients – from families to investors and everyone in between – guiding them through the refinancing process to achieve real savings and financial freedom. I know that refinancing isn’t just about securing a better rate, it’s about reducing stress, building wealth, and creating opportunities for your future.

At Bonfire Finance, we specialise in refinancing. That means we don’t just find you a loan – we help you understand your equity, explore your options, and ensure your mortgage works harder for you. My team and I pride ourselves on being approachable, transparent, and 100% focused on what’s best for you.

Think of us as your mortgage co-pilot: we’ll handle the tricky lender stuff so you can focus on what matters most – enjoying the benefits of a smarter, more flexible home loan.